Share this

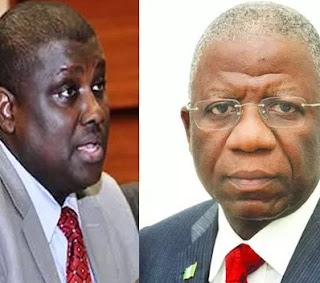

The trial of Stephen Oronsaye, a former Head of Service, HoS, continued today November 14th, with a prosecution witness, Rouqayya Ibrahim, narrating how pension funds were diverted through the approval and release of funds for non-existent contracts.

Oronsaye is standing trial before Justice Gabriel Kolawole of the Federal High Court Abuja for a 24-count charge bordering on stealing and obtaining money false pretence. He is standing trial along with Osarenkhoe Afe, managing director, Fredrick Hamilton Global Services Limited. They are alleged to have been complicit in several contract awards during his tenure as HoS. The fraud was allegedly perpetrated using Cluster Logistic Limited, Kongolo Dynamic Cleaning Limited, Drew Investment and Construction Company Limited, and Xangee Technologies Limited, for shady deals to the tune of N2 billion.

At the proceeding, prosecuting counsel, Rotimi Jacobs, SAN, applied to tender three statements made to the EFCC Oronsaye, during the course of investigations. The statements were identified Ibrahim, who is a member of the EFCC’s Pension Fraud Team that recorded the statements.

There were no objections raised to the admissibility of the statements as Joe Agi, SAN the lead counsel for Oronsaye, and Oluwole Aladedoye, counsel for Afe and Fredrick Hamilton Global Services Limited both said: “We have no objections, my lord”.

Justice Kolawole thereafter admitted Oronsaye’s statements made on December 7, 2013, July 8, 2015 and July 9, 2015 as Exhibits 2, 2a, and 2b. Ibrahim, who was led in evidence Jacobs, told the court that in the course of investigations, the EFCC requested for payment mandate from the office of the HoS.

“we analysed the mandate, obtained necessary information like bank account numbers, and then requested for the account statements from the banks,” she said.

“we analysed the mandate, obtained necessary information like bank account numbers, and then requested for the account statements from the banks,” she said.

She revealed that the analysis threw up the company, Xangee Technologies Limited, which according to her is also standing trial before Justice Abubakar Talba of the Federal Capital Territory High Court, Gudu, for pension fraud.

“We discovered that the company received payment of more than N183 million for biometric enrolment, but there was no biometric contract executed the company, instead the money was withdrawn cash, converted to US dollars and handed over to Abdulrasheed Maina, through his brother, Khalid Biu,” she added. She further told the court that three companies – Mofshad Ventures, Mofshad Limited and Kombosko Nigeria Limited, received more than N400 million for non-existent contracts.

“We discovered that the three companies were associated with one Emmanuel Olanipekun, who is also currently standing trial, and one Chidi also standing trial, and the monies were withdrawn in cash with part of it given to Mr. Oronsaye,” she said.

According to her, investigation of the pension account with Union Bank, revealed that the there was a letter afterwards written, instructing that the money be transferred to another pension account.

“We saw another letter on it, on which there was a minute and instruction from Mr. Oronsaye, to transfer about N113 million to a Unity Bank account belonging to the State House, which we discovered he was the sole-signatory,” she said.

Ibrahim informed the court that “as at the time the transfer was made in 2010, Oronsaye had seized to be the Principal Secretary in the State House and had become the Head of Service”.

“We discovered that the monies were withdrawn through cheques, but all efforts to get the person to whom they were issued to, was unsuccessful, and Mr. Oronsaye could not explain the reason for the disbursement,” she added.

Investigation of such suspicious transfers, according to her, led investigators to discover six accounts with Fidelity Bank in the name of Faizal Abdullahi, Mafisa Abdullahi, Kongolo Dynamic Cleaning Limited, Drew Investment and Construction Company Limited, and Cluster Logistic Limited.

“There was also another account in the name of Abdulrasheed Maina, and his brother, Biu, a staff of the bank, opened the accounts and was the accounts officer,” she said.

According to Ibrahim, after Biu resigned from the bank, Toyin Meseke, a staff of the bank took over as the account officer. We invited him for an interview and discovered that all the accounts were operated Abdulrasheed Maina, even though his name, picture and signature were not anywhere in the opening account packages,” she added.

Explaining further, she told the court that Maina operated the account mainly through text messages and emails, as “instructions regarding payment or withdrawal were sent to Meseke text or email”.

In order to unravel the fraudulent transactions linked to the account, Ibrahim told the court that forensic analysis of Meseke’s phone was carried out, which revealed how funds were fraudulently diverted from the account.

In order to unravel the fraudulent transactions linked to the account, Ibrahim told the court that forensic analysis of Meseke’s phone was carried out, which revealed how funds were fraudulently diverted from the account.

“The account officer will after receiving instruction from Maina, convert the money to US dollars and deliver same to him in Dubai,” she said

She further told the court that Maina, a former Chairman, Presidential Task Force on Pension Reforms remained at large, as he never showed up in the course of investigations, and deserted his known residence.

“Apart from the Interpol notice for his arrest, we are still doing all we can, but yet to get hold of him,” she said, and added that investigations showed that Maina paid cash of $2 million for purchase of a house in Jabi.

Justice Kolawole thereafter adjourned to December 5, 2017 for continuation.

Source: Linda ikeji